In the current rapidly changing financial markets, traders continuously seeking a competitive advantage to secure profits and minimize risks. A highly effective method to attain this is through the utilization of advanced software tools that can automate and enhance trading strategies. These software solutions have revolutionized the environment of trading, providing both new traders and experienced professionals with powerful resources to examine market trends, execute trades efficiently, and oversee investments successfully.

The advantages of employing a software system are numerous. From real-time data analysis to algorithmic trading features, software tools enable traders to formulate informed decisions based on extensive market information free from the emotional biases that often accompany manual trading. Embracing automation in trading does not just streamline processes but also allows for quicker reaction times, thereby optimizing potential returns. As we delve deeper into the advantages of these software tools, it becomes clear that they are no more just an option but a requirement for anyone looking to thrive in the competitive trading environment.

Advantages of Automation in Trade Execution

One of the primary advantages of automation in trade execution is the capability to execute trades with extraordinary velocity and precision. Automated trading platforms utilize computer algorithms to analyze financial data in real-time, allowing traders to capitalize on opportunities that would be hard to notice or respond to manually. This fast execution minimizes the risks associated with market volatility and allows traders to secure better rates for their orders.

Another significant benefit is the reduction of psychological choices. Trading activities can often cause anxiety and lead to rash choices driven by panic or greed. By using automated tools, investors can adhere to predefined strategies and guidelines, removing the influence of emotions on their trading practices. This systematic approach often leads to more consistent performance and improved risk management, ultimately contributing to long-term success.

Lastly, automating allows traders to diversify their asset portfolios more efficiently. With the ability to track multiple markets and instruments simultaneously, investors can capitalize on different trading opportunities without the need for constant oversight. This effectiveness not only boosts the possibility for gain but also spreads exposure across various investment types, leading to a balanced trading strategy.

Main Advantages of Trading Platforms

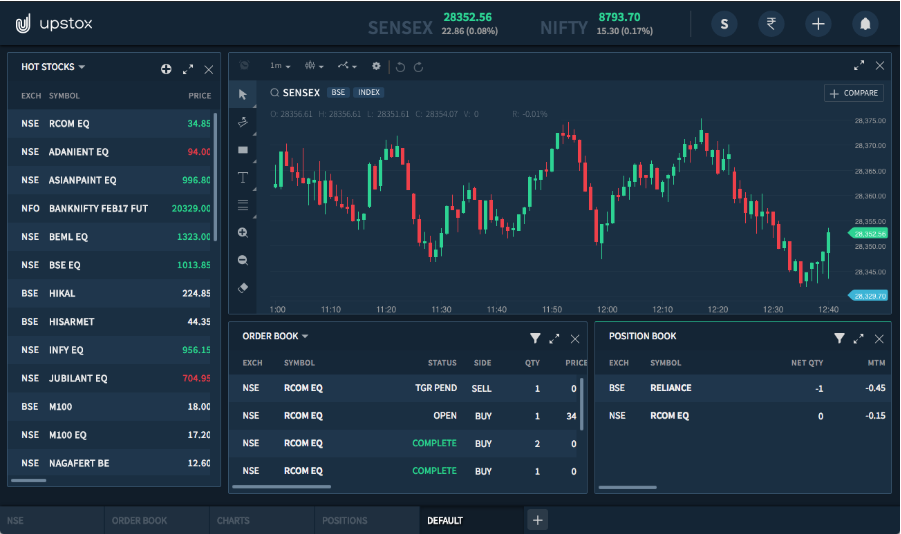

One of the standout features of trading software is instant information evaluation. Traders can obtain live market data, enabling them to make prompt decisions based on present market conditions. This immediate access to insights helps traders recognize market trends, watch prices, and respond swiftly to evolving environments, which can considerably enhance their trading strategies and improve general effectiveness.

Another crucial feature is automated trading capabilities. A trading system with automated functions allows for setting predefined criteria for buying and selling assets. This feature lessens the stress often associated with trading by allowing traders to rely on programs that perform trades based on specific parameters. As a consequence, traders can stay disciplined and take advantage of opportunities without the influence of psychological factors.

User-friendly interfaces are also a crucial aspect of trading software. An user-friendly design allows both beginner and seasoned traders to operate the platform with ease. Comprehensive charting tools, personalized dashboards, and effective order execution are important features that improve the trading experience. A well-designed interface can lead to more rapid decision-making and enhanced efficiency, which are essential in the rapid world of trading.

Case Studies of Successful Automated Trading

One notable case study in automated trading is that of Renaissance Technologies, a hedge fund famous for its quantitative approach and advanced trading systems. Founded by https://www.tradesoft.es/ , Renaissance makes use of complex mathematical models and algorithms to detect market inefficiencies. Their Medallion Fund has consistently outperformed the market, mainly because of its reliance on automated trading strategies that evaluate vast amounts of data to make rapid trading decisions.

One more compelling example can be found in the use of trading bots by individual traders in the cryptocurrency market. Numerous traders have reported significant success by using automated trading systems that take advantage of market fluctuations. For instance, users of platforms like 3Commas have been able to create trading bots that carry out buy and sell orders based on pre-set parameters, enabling continuous trading without the need for manual intervention. This has permitted traders to take advantage of the volatile nature of cryptocurrencies while reducing emotional decision making.

Finally, the case of Forex trading illustrates the effectiveness of automated systems in a highly liquid market. Brokers like IG offer algorithmic trading solutions that allow clients to automate their strategies using backtesting and risk management tools. Traders who use these systems have obtained more consistent results since automated trading can operate around the clock, performing trades at optimal times based on market conditions, thus maximizing profitability and minimizing losses.